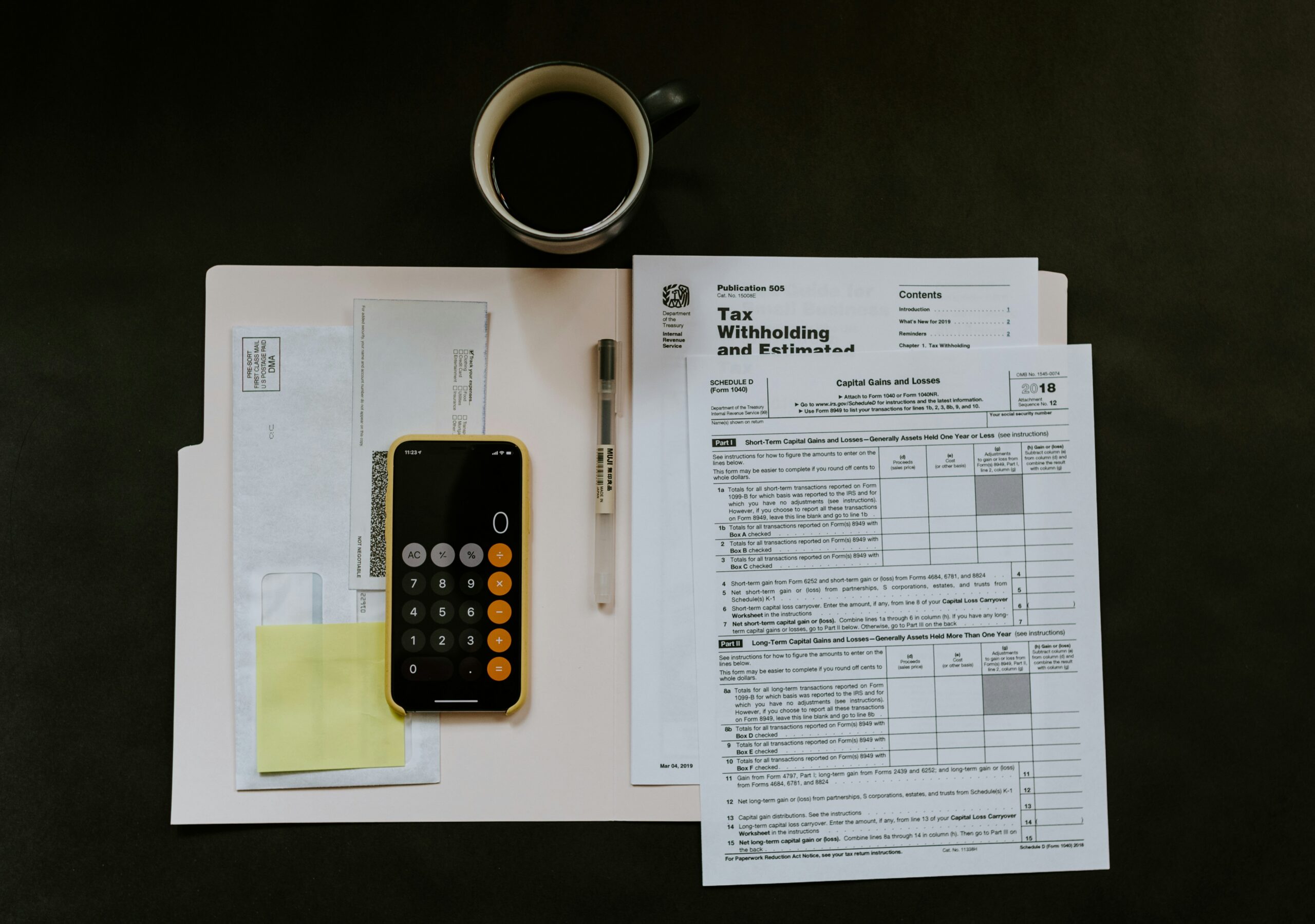

Navigating the world of taxes can be a dizzying experience, with an array of credits and deductions that promise to ease the financial load.

Yet, tax credits are among the most valuable for individuals and small business owners alike. These critical reductions can directly reduce the amount owed to the government.

When understood and applied correctly, these tools lower tax liability and foster significant savings, driving growth and stability.

For the savvy small business owner, mastering the intricacies of tax credits like the premium tax credit or the small employer health insurance credit can transform an annual fiscal headache into a cause for celebration.

Keep reading to unlock the secrets of tax credits and learn how they can benefit your bottom line.

Key Takeaways

- Tax Credits Offer a Dollar-for-Dollar Reduction in Tax Owed, Unlike Deductions Which Reduce Taxable Income.

- Small Businesses Must Closely Follow Eligibility Criteria to Benefit From Tax Credits, Such as the Small Employer Health Insurance Credit.

- Strategic Financial Planning, Including the Timing of Expenses, Can Increase a Small Business’s Eligibility for Tax Credits.

- Maintaining Accurate Financial Records Is Essential for Substantiating Tax Credit Claims and Remaining Compliant.

- Understanding and Avoiding Common Mistakes Can Help Maximize the Benefits of Various Tax Credits, From EITC to Education-Specific Incentives

Exploring the Basics of Tax Credits

As small business owners navigate the realm of fiscal responsibilities, understanding the intricacies of tax credits becomes crucial.

These financial incentives can significantly trim down the tax liability, acting almost like a gift card against the tax bill.

Unlike deductions, which reduce the amount of taxable income, tax credits offer a dollar-for-dollar reduction in the actual tax owed.

Businesses need to know the eligibility requirements, which can drastically affect the bottom line.

Wading through the maze of tax credits reveals a range of options, from employment incentives to energy efficiency rewards.

Addressing common misconceptions, it’s important to highlight that not all credits are refundable, and not all businesses will qualify for each credit.

This section aims to equip business owners with a foundational comprehension of tax credits and their potential impact on the organization’s finances.

Definition and Types of Tax Credits

At the core, a tax credit is a provision that allows taxpayers to subtract a certain amount of money directly from the taxes they owe to the government. These credits come in different types, often catered to foster certain activities or behavior within the economy, whether it’s investment in renewable energy, providing employee benefits, or, relevant here, health insurance for staff. Common types of credits include nonrefundable, refundable, and partially refundable – each with unique ways they affect the bottom line.

| Type of Tax Credit | Description | Effectiveness for Businesses |

|---|---|---|

| Nonrefundable | Deduct from the total tax bill until it reaches zero | Limited to the business’s tax liability |

| Refundable | Receive a refund for any amount that exceeds the tax liability | Can provide funds beyond tax liability |

| Partially Refundable | Offer a nontaxable portion back while the rest balances the owed tax | Combines the benefits of both types |

Understanding How Tax Credits Differ From Deductions

The landscape of tax savings is often mistaken as a one-size-fits-all, yet tax credits and deductions are distinct tools that serve different roles for small businesses. A deduction decreases the income subject to tax, potentially dropping the business into a lower tax bracket, thus reducing the overall tax percentage applied to their income. Conversely, a tax credit reduces the tax owed, dollar-for-dollar, providing more direct and often more beneficial savings than a deduction might offer.

The Role of Tax Credits in Reducing Tax Liability

The right tax credit can turn the tide of a small business’s fiscal year by injecting much-needed relief into its financial strategy. These credits shave off a portion of owed taxes, directly reducing the amount a business has to pay the Internal Revenue Service. By capitalizing on credits like the small employer health insurance credit, businesses not only support their employees’ health needs but also manage to conserve valuable revenue that can be redirected toward growth and development.

Eligibility Criteria for Various Tax Credits

Small businesses must closely follow set eligibility criteria to secure tax credits, which vary widely depending on the specific credit. Factors such as the number of employees, the type of health insurance plans offered, and adherence to the provisions of the Affordable Care Act can all influence a small business’s qualification for something like the premium tax credit. Owners need to ensure that every aspect of their employment, payroll, and health care enrollment records align with the stringent requirements laid out by the law and overseen by the Internal Revenue Service to tap into potential credits.

Common Misconceptions About Tax Credits

In the world of small business, a pervasive myth suggests that tax credits can be freely interchanged with deductions. Yet, the truth tells a different story: Credits are far more valuable due to their direct offset against tax owed, not merely a reduction in taxable income. There’s also a mistaken belief that all tax credits are universally available, but in reality, each comes with stringent qualifying criteria, and not all businesses will be eligible for every credit offered.

- Understanding the difference between credits and deductions is vital for effective business financial planning.

- Not all tax credits are accessible to every business; eligibility requirements must be carefully reviewed.

- Tax credits’ value and applicability are dictated by various factors, including business size, insurance offerings, and legal compliance.

Eligibility Requirements for Major Tax Credits

Navigating the landscape of tax credits can feel like solving a complex puzzle for small business owners and individual taxpayers alike.

Meeting specific criteria to benefit from these valuable financial incentives is crucial.

Factors like income, family size, and filing status play a significant role for individuals seeking the Earned Income Tax Credit.

Similarly, parents and guardians must understand the Child and Dependent Care Credit qualifications, which can provide relief based on childcare expenses.

Education-related tax credits call for their own set of regulations, where taxpayers should familiarize themselves with the American Opportunity Tax Credit’s educational stipulations and the Lifetime Learning Credit’s scope for various courses and degree programs.

Anyone looking to leverage potential tax savings must grasp the eligibility requirements for these major tax credits.

Criteria for Earned Income Tax Credit (EITC)

To obtain the Earned Income Tax Credit, meticulously meeting income thresholds becomes a prerequisite, which hinges on earnings and adjusted gross income levels. Single and married individuals must adhere to distinct income limitations influenced by the number of qualifying children claimed. EITC eligibility also requires that all workers and businesses have a valid Social Security number and that their file status is not married, filing separately.

Qualifications for Child and Dependent Care Credit

For the Child and Dependent Care Credit, eligibility hinges on the expenses incurred by a small business or taxpayer in caring for children under 13 or disabled dependents. Parents or guardians must have incurred these expenses to work or actively seek employment, and the caregiver cannot be someone the taxpayer counts as a dependent.

Understanding the American Opportunity Tax Credit (AOTC)

Unlocking the benefits of the American Opportunity Tax Credit (AOTC) is like striking academic gold for eligible taxpayers. This credit aims to assist with the first four years of higher education by covering qualified educational expenses such as tuition, course materials, and fees, with the potential to claim up to $2,500 per eligible student each year, $1,000 of which may be refundable.

| Education Level | Qualified Expenses | Credit Value | Refundability |

|---|---|---|---|

| Undergraduate (First 4 years) | Tuition, course materials, fees | Up to $2,500 per student | $1,000 may be refundable |

Requirements for the Lifetime Learning Credit

The Lifetime Learning Credit offers financial support for those seeking post-secondary education throughout their lives without the constraint of being in the first four years of post-secondary education. To qualify, the taxpayer must have incurred education-related expenses, such as tuition and fees, at an eligible educational institution. This credit casts a wider net, allowing for a broader range of courses and training that enhance job skills, painting a hopeful picture for lifelong learners aiming to grow professionally or switch careers.

How to Calculate Your Tax Credits

Embarking on the journey of tax credit calculations is akin to mapping a financial voyage, with the right techniques ensuring a bounty of savings.

Full of complex rules and percentages, knowing how to precisely figure out the value of tax credits, like the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit, proves pivotal for small businesses seeking to maximize benefits.

This section serves as a navigational aid, presenting clear directives for small business owners to determine the exact credit amount they’re entitled to.

Additionally, it illuminates the crucial tools and resources that streamline the process of calculating education-related credit.

As not all credits are calculated equally, gaining expertise in adjusting for partial credits unearths additional financial treasures for adept business navigators.

Step-by-Step Guide to Calculating EITC

To calculate the Earned Income Tax Credit, one must first determine their Adjusted Gross Income (AGI) and confirm that it falls within the IRS-set income limits for the tax year. Taxpayers then compare their earned income to their AGI and use the lesser of the two to locate the correct credit amount in the EITC table provided by the IRS. The resulting figure gives taxpayers the precise credit they may claim, subject to further verification of qualifying children and filing status requirements.

Calculating Your Child and Dependent Care Credit

When tackling the Child and Dependent Care Credit, small business owners and individual taxpayers must calculate the percentage of their allowable expenses that relate to childcare. The IRS permits a percentage of these qualifying costs to be credited based on income, with lower incomes benefitting from a higher percentage. Individuals must identify expenses up to the current year’s limit for one or more dependents, ensuring proper documentation to substantiate the childcare expenses claimed on their tax return.

Tools and Resources for Calculating Education Credits

Calculating education credits requires leveraging the right tools and resources to ensure accuracy and compliance. The Internal Revenue Service offers detailed publications and a dedicated education credits section on their website to assist taxpayers. Additionally, tax preparation software often includes built-in calculators that simplify the process by guiding users step by step through claiming credits like the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit.

| Credit | Resource | Feature | Benefit |

|---|---|---|---|

| American Opportunity Tax Credit | IRS Publication | Comprehensive Guidelines | Ensures eligibility and maximizes claim |

| Lifetime Learning Credit | IRS Website | Detailed Information | Clarifies qualified expenses and limits |

| General Education Credits | Tax Software | Interactive Calculators | Streamlines computation and filing |

Adjusting Your Calculations for Partial Credits

Mastering the calculations for partial tax credits can be nuanced, calling for a sharp eye on pro-rating these benefits. The owner must apportion the credit correctly throughout the fiscal year if a small business qualifies partially for a tax credit—like the small employer health insurance credit due to varying coverage periods or employee count fluctuations. This ensures the credit amount accurately reflects the eligible span of tax-relief opportunities.

| Tax Credit Scenario | Eligible Period | Partial Credit Calculation | Resulting Credit Adjustment |

|---|---|---|---|

| Small Employer Health Insurance Credit | 6 months of the year | 50% of the yearly entitled amount | Pro-rated credit for the actual time coverage was provided |

Maximizing Your Tax Credits

Exploring the options for increasing tax credit eligibility is akin to refining a strategy in a game of chess—every move matters and can significantly influence the outcome.

Small business owners can adopt a proactive approach to timing expenses, ensuring they align with fiscal periods that optimize the benefits of available tax credits, which often ebb and flow with revenue and different business cycles.

Recordkeeping accuracy remains the linchpin in substantiating these tax-saving measures, as well-organized financial data solidifies the foundation for all claims.

Equally vital is aligning with a knowledgeable tax professional whose expertise can unlock the full spectrum of benefits, guiding businesses through the labyrinth of tax laws and credits to maximize returns without compromising compliance.

This comprehensive approach lays the groundwork for tapping into the full potential of tax credits, providing organizations with the fiscal agility to thrive.

Strategies for Increasing Your Eligibility

Small business owners looking to increase their eligibility for tax credits should focus on aligning their business practices with the criteria set by tax laws. By providing comprehensive health insurance plans that meet the standards of the Affordable Care Act and by maintaining accurate documentation of all health-related expenditures, these businesses enhance their chances of qualifying for valuable tax credits such as the premium tax credit or the small employer health insurance credit.

Timing Expenses to Optimize Tax Credits

Small businesses can strategically manage their expenses to enhance their eligibility for tax credits. Businesses optimize their financial planning by scheduling significant expenditures, such as equipment purchases or health insurance premium payments, to coincide with periods that would yield the most tax credit advantages. Timing is everything, and savvy management of the fiscal calendar can lead to substantial savings through meticulous leveraging of tax credit opportunities.

The Importance of Accurate Record-Keeping

Maintaining precise financial records is more than just good business practice; it’s a crucial strategy for validating tax credit claims. When small business owners preserve accurate and detailed accounts of all expenses, they construct a robust audit trail that substantiates eligibility for tax credits, ensuring they can fully capitalize on these valuable deductions without stumbling over compliance hurdles.

Consulting a Tax Professional for Maximizing Benefits

Enlisting the aid of a tax professional is a strategic move for small business owners seeking to maximize their tax credit benefits. These experts deeply understand tax legislation and can offer personalized advice tailored to each unique business situation. A skilled tax consultant helps identify all applicable credits and ensures accurate filing, vastly improving a business’s financial outcome.

| Service | Benefits |

|---|---|

| Tax Credit Identification | Ensures no eligible credit is missed |

| Accuracy in Filing | Reduces errors and the risk of audits |

| Strategic Planning | Aligns business actions with tax benefits |

| Compliance Assurance | Maintains alignment with the latest tax laws |

Tax Credits for Small Business Owners

Small business owners often find themselves at a crossroads when it comes to reducing their financial burdens through tax incentives.

With a variety of credits available, the challenge lies in pinpointing which ones align with their operation.

Identifying the right mix of tax credits requires a clear understanding of each option, from the healthcare-related relief provided by the Small Business Health Care Tax Credit to the innovation-encouraging benefits of the Research and Development (R&D) Credit.

Additionally, businesses that enhance their operations with energy-efficient solutions may be eligible for specific credits to reward such green initiatives.

These elements, together with strategic advice on how to claim them effectively, form the cornerstone of businesses’ diligent expense management and reinvestment in growth and sustainability.

Identifying Credits Available to Businesses

Small businesses can ease their financial burden by tapping into a variety of tax credits tailored to their specific needs. Identifying which credits are accessible necessitates a thorough review of the organization’s expenses and activities, with a special eye on credits like the Small Employer Health Insurance Credit, which supports those offering health insurance to employees. Understanding the credits available can unlock potential savings and contribute to a stronger, more resilient business model.

Navigating the Small Business Health Care Tax Credit

For small business owners, navigating the Small Business Health Care Tax Credit involves carefully reviewing their insurance offerings against the Affordable Care Act standards. Small businesses that meet the criteria, such as having fewer than 25 full-time employees and offering health insurance through the Small Business Health Options Program, can receive a credit for a portion of their contributions. This vital credit aims to make employee health care more affordable, aiding employers in attracting and retaining a healthy workforce.

Understanding the Research and Development (R&D) Credit

For small business owners investing in innovation, the Research and Development (R&D) Credit is a lucrative incentive to offset the costs associated with exploring new frontiers. This tax credit directly benefits businesses that engage in qualified research activities, aiming to foster innovation and technological advancement within various industries, from software development to biotechnology and beyond.

| Activity | Industry | Benefit |

|---|---|---|

| Qualified Research | Software Development | Reduces tax liability for research expenses |

| Experimental Development | Biotechnology | Encourages innovative product development |

| Process Improvement | Manufacturing | Supports efficiency enhancements |

Tips for Claiming Energy Efficiency Credits

Capitalizing on energy efficiency credits is a strategic way for small businesses to lower their tax liability while contributing to environmental sustainability. Business owners should invest in certified energy-saving equipment or make improvements to their facilities that meet the criteria for federal or state energy credits, and remember to keep receipts and product information to substantiate their claims. By staying informed about available energy efficiency credits and maintaining detailed records, businesses can ensure they receive the maximum financial advantage for their eco-friendly investments.

Common Pitfalls and How to Avoid Them

Navigating the realm of tax credits is akin to charting a course through uncharted fiscal waters.

It’s fraught with potential missteps that can lead to missed opportunities or even penalties.

Small business owners, in particular, must tread carefully to avoid pitfalls when it comes to correctly claiming the Earned Income Tax Credit (EITC), navigating the subtleties of education credits, recognizing state-specific tax incentives, and understanding how amended returns can alter one’s tax credit landscape.

Armed with the right knowledge, businesses can ensure a smoother voyage toward maximizing their benefits without unforeseen disruptions.

Errors to Avoid When Claiming EITC

One critical error to avoid when claiming the Earned Income Tax Credit is overestimating income or claiming a child who does not meet the residency requirements. Accuracy is paramount; business owners must ensure that income reports match tax documents and that every child claimed has lived with the taxpayer for more than half of the tax year, as the Internal Revenue Service closely scrutinizes these claims.

Missteps in Claiming Education Credits

Claiming education credits requires careful attention to the tax laws governing eligibility and qualified expenses. A common misstep includes misunderstanding the types of expenses that can be claimed: not all educational costs qualify for credits like the American Opportunity Tax Credit or the Lifetime Learning Credit.

- Ensure the educational institution is eligible for the tax credit being claimed.

- Verify that the expenses are qualified, as not all educational costs are covered under the credits.

- Claim the credit for the correct tax year, correlating with when the qualifying expenses were paid.

Overlooking State-Specific Tax Credits

Small business owners sometimes focus so intently on federal tax incentives that they overlook the additional savings state-specific credits offer. Each state’s tax code is unique, with various credits designed to stimulate local economic growth or encourage certain behaviors, such as hiring from specific demographics or investing in community betterment. Businesses must investigate these state-level credits, which could provide substantial financial benefits when coupled with federal incentives.

The Impact of Amended Returns on Tax Credits

Adjusting previously filed tax returns can profoundly affect an organization’s tax credits. An amended return might be necessary when a small business discovers qualifying expenses or credits were overlooked, potentially resulting in an increase in the credit amount. Careful resubmission, adhering to IRS protocols, safeguards the business’s entitlement while correcting any discrepancies, ensuring full utilization of the financial relief available through tax credits.

Conclusion

A thorough understanding of tax credits is key to elevating a small business’s financial health, allowing owners to capitalize on a range of incentives that directly reduce tax liability.

By distinguishing between various types of credits, ensuring eligibility, and maintaining precise financial records, businesses can effectively decrease their tax burden.

Expert guidance from tax professionals further maximizes potential savings and ensures compliance with complex tax laws.

Ultimately, leveraging tax credits can lead to substantial fiscal benefits, enabling reinvestment in growth and sustainability.